OTSC

Its time that justice is served and those responsible for the destruction of Nanologix, Inc. or the Directors who allowed it by disregarding their fiduciary responsibility to the shareholders be held accountable. Over the next few days we will be providing you with our plan and discussing our efforts to resurrect the company and to build shareholder value. Stay tuned! In the meantime constructive comments will be accepted at tom@nanologixlitigation.com

DID YOU KNOW

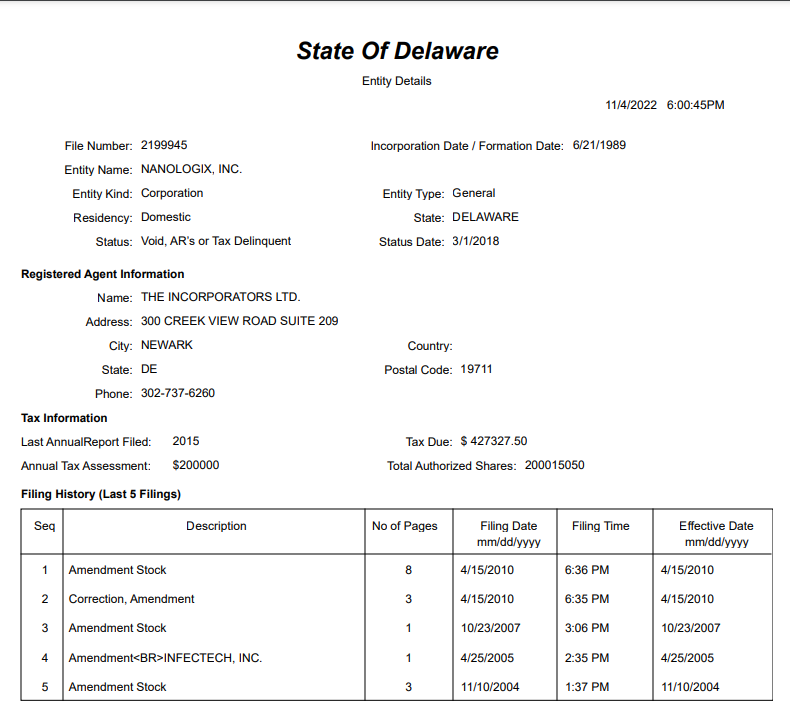

There have been no Annual Reports filed with the State of Delaware since 2015 and as of 11/4/22 there was $427,327. 50 due for delinquent taxes causing a revocation of the corporation on 3/1/18. Could that be why your stock no longer trades? Because management would have had to cause the filing of financial statements attesting to the fact it was in good corporate standing when it was revoked and that there was over $400,000.00 in debt due for delinquent taxes? What other debt is due? Could that be the reason the company cannot raise the funds to finalize the development of the RVA which if successful would presumably have put the company on the map with considerable value? Could it be the reason a shareholders meeting hasn’t been held for years? What other skeletons are in the Nanologix closet? Where were the directors between 2015 and 2018 when no Annual Reports were filed and delinquent taxes were piling up that caused the revocation of the corporate charter? Could it be the reason the Faro’s resigned as directors once they became aware of the debt, the revocation of the corporation and the total mismanagement of your company?

Update

Over the past few weeks I have communicated with Bret about our proposal to merge, acquire, or license the technologies. Unfortunately Bret being Bret a guy who has not done a thing in 15 years and has destroyed what is a very valuable enterprise our discussions were again derailed. In my opinion I believe there are so many skeletons in the Nanologix closets he cannot complete any arrangement.

So you can understand, we proposed transferring all rights and ownership in 2 technologies we own into a new corporation (NEWCO) . That corporation would enter into a license agreement for US rights only with NNLX for both the N Assay and RVA technologies,. In consideration of the license agreement NewCo would issue 25% of the fully diluted shares to you individual NNLX shareholders pro rata. In addition, New Co will immediately fund the development of the assay.

As I advised Bret, New Co has an agreement with a mid level broker dealer to conduct an equity offering to sell 15% of its equity for $5,000,000 which would place a value of $8,333,333 on the 25% owned collectively by NNLX shareholders. It is important to state that you the NNLX shareholders will continue to retain your NNLX stock and that NNLX will retain all international rights to the technologies.

In addition to raising the initial $5m it is our intention assuming the development of the assay is successful to initiate a $50- $75,000,000 public offering through the broker dealer and to list the company on NASDAQ. In our proposal we agreed that we would register all shares that were issued to NNLX shareholders which would make them saleable in the public market place.

Although we believe such an agreement is a win win win win for NNLX and its shareholders Bret proposed that instead of providing you with agreement that would provide you with liquidity that we pay NNLX a 40% royalty.. Such a proposal is the reason he has not accomplished ANYTHING in 15 years. Its ludicrous! There is at least 2-3 years of research and development to be done before the 1st test could be sold if ever. While 40% of 0 = 0, the value of your equity in NewCo could be significant.

Although I believed that it would be best to attempt to work with Bret to come up with a plan that would benefit all of us it is clear to us that it is just not possible. As our agreement with the broker dealer has a 90 day expiration which has started we believe the most expeditious way to pursue the agreement we proposed is to seek the courts intervention.

As I have explained in the past, to be successful in litigation you must first establish "standing", in other words that you were or will be harmed. Although we have a very minor position in NNLX we believe it provides us standing to bring and sustain an action however as you can imagine the more harm we can establish the more likely the court will grant our request.

Initially, our action against NNLX / Bret will be to seek an order from the court compelling Bret, etal to conduct a shareholders meeting and to provide typical accounting information and to hold a mandatory election of board members. Although we suspect that Bret, etal controls the majority of the shares and will be able to vote those shares to elect his slate of directors I question if anyone would agree to serve with him due to the significant legal issues facing the company, not to mention the corporation no longer exists. Why do you think both Faro's who have significant liability due to their "look the other way and let Bret do as he wishes" resigned?

In closing ....we need your help and you need ours. The more harm we can establish for the court the better chance we have of getting a decision that will order Bret to conduct a long overdue shareholders meeting. That is all we are seeking so that we can properly present to you the shareholders our proposal discussed herein. We have no other motive.

I have advised Bret of our intention to file the action but left open the opportunity to agree to call and conduct the meeting. In the meantime if you have an interest in assisting us by simply stating the length of time you have been invested and the amount of the investment it will go along way in convincing the court to grant our request. Your response to tom@nanologixlitigation.com would be appreciated. Together we can restore the significant value Bret has destroyed!

Thanks

Tom